Investor Overview

Investor Overview Q3 2021 Copperleaf Technologies Inc. © 2022 Proprietary & Confidential

Disclaimer This presentation is being issued by Copperleaf Technologies Inc. (the “Company”) for information purposes only. Reliance on this presentation for the purpose of engaging in any investment activity may expose a person to significant risk of losing all of the money, property or other assets invested. This presentation does not constitute or form part of, and should not be construed as, an offer or invitation to sell or any solicitation of any offer to purchase or subscribe for any securities in Canada, the United States or any other jurisdiction. Neither this presentation, nor any part of it, nor anything contained or referred to in it, nor the fact of its distribution, should form the basis of or be relied on in connection with or act as an inducement in relation to a decision to purchase or subscribe for or enter into any contract or make any other commitment whatsoever in relation to any securities of the Company. No person has been authorized to give any information or to make any representations not contained in this presentation. Any such information or representation that is given or received must not be relied upon. Certain information contained herein includes market and industry data that has been obtained from or is based upon estimates derived from third party sources, including industry publications, reports and websites. Third party sources may state that the information contained therein has been obtained from sources believed to be reliable, but there is no assurance or guarantee as to the accuracy or completeness of included data. Although the data is believed to be reliable, neither the Company nor its agents have independently verified the accuracy, currency, reliability or completeness of any of the information from third party sources referred to in this presentation or ascertained from the underlying economic assumptions relied upon by such sources. The Company disclaims any responsibility or liability whatsoever in respect of any third party sources of market and industry data or information. This Presentation refers to certain financial performance measures that are not defined by and do not have a standardized meaning under International Financial Reporting Standards (termed "Non-IFRS measures") such as Annual Recurring Revenue, Net Revenue Retention Rate, Revenue Backlog, and Adjusted EBITDA. Non-IFRS measures are used by management to assess the financial and operational performance of the Company. The Company believes that these Non-IFRS measures, in addition to conventional measures prepared in accordance with International Financial Reporting Standard, enable investors to evaluate the Company’s operating results, underlying performance and prospects in a similar manner to the Company’s management. As there are no standardized methods of calculating these Non-IFRS measures, the Company’s approach may differ from those used by others, and accordingly, the use of these measures may not be directly comparable. Accordingly, these Non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with International Financial Reporting Standards. Certain information included in this presentation includes “forward-looking statements” and “forward-looking information” within the meaning of applicable securities law (collectively referred to in this presentation as “forward looking statements”). All such statements and disclosures, other than those of historical fact, which address activities, events, outcomes, results or developments that the Company anticipates or expects may, or will occur in the future (in whole or in part) should be considered forward-looking statements. In some cases, forward-looking statements can be identified by the use of the words “expect”, “will” and similar expressions. In particular, but without limiting the foregoing, this presentation contains forward-looking statements pertaining to the following: industry trends, anticipated key benefits to clients, growth expectations relating to Copperleaf, sales cycles, growth strategies and opportunities, product development and expansion, and market opportunity and growth. This presentation should be read in conjunction with the risk factors described in the “Summary of Factors Affecting Our Performance” section of the Company’s management’s discussion and analysis and the “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Information” sections of the Company’s supplemented long form PREP prospectus dated October 6, 2021 which are available under the Company’s profile at www.sedar.com. Bytheir nature, forward-looking statements are subject to numerous risks and uncertainties. You are cautioned that the assumptions used in the preparation of forward looking statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. Actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. No assurance can be given that any of the events anticipated will transpire or occur, or if any of them do so, what benefits the Company will derive from them. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise unless required by law. Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 2

Decision Analytics for Critical Infrastructure We help companies decide where and when to invest in their business to manage risk, deliver on their performance expectations, achieve their strategic goals, and maximize capital efficiency. Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 3

Copperleaf At a Glance End-to-End AI-Powered Decision Analytics Software Solution $64M 74% 52% 50% TTM Total TTM Revenue TTM ARR TTM Revenue Revenue Growth Growth Backlog Growth 100% 125% NPS70 Client Retention TTM Net Revenue Copperleaf Retention Rate Experience TTM(Trailing TwelveMonths)is measured at Sep 30,2021 Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 4

Why is Making Investment Decisions a Challenge? 1. 2. 3. 4. 5. 6. 7. No way No quantitative Too much Intuition, Inability Struggle Inconsistent to properly link between time spent advocacy to compare to quickly processes to evaluate spending and entering data & internal dissimilar respond to the make the right financial & strategic & “number politics drive investments unexpected investment or non-financial objectives, crunching” prioritization and defend e.g. emergent sustainment benefits when including ESG portfolio work, decisions making targets decisions regulatory decisions requirements Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 5

ESG: A Key Business Imperative • Investors, customers and governments are demanding ESG action Environmental • Energy transition, net zero, GHG emission reductions, climate resilience, biodiversity, water use, waste management, pollution control Social • Employee safety, public safety, service reliability, diversity, community development Governance • Risk management, cyber security, anti-corruption, board independence Organizations must invest to make tangible progress towards ESG commitments Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 6

How Does Copperleaf Help? We democratize decision-making by providing the visibility and analytics needed to make the Ultimately, a right investment trade-offs company’s value is • Infuse decision-making with strategy just the sum of the • Use data in decision-making decisions it makes • Combine human intelligence with artificial and executes. intelligence to improve performance • Create a value-based culture which HARVARD BUSINESS REVIEW encompasses the interests of all stakeholders Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 7

Best-in-Class Decision Analytics Capabilities • Forecast sustainment needs • Make the highest-value decisions and • Increase business agility and and proactively manage risk create the optimal investment strategy transparency across the enterprise Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 8

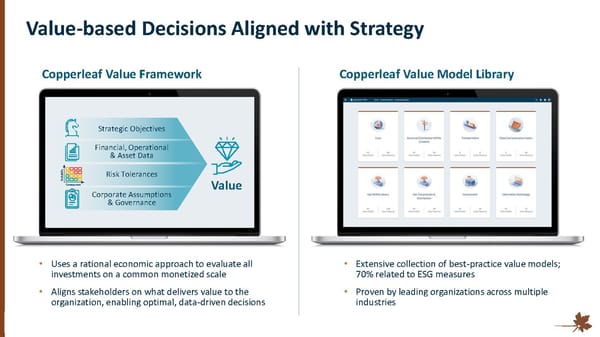

Value-based Decisions Aligned with Strategy Copperleaf Value Framework Copperleaf Value Model Library Strategic Objectives Financial, Operational & Asset Data Risk Tolerances Value Corporate Assumptions & Governance • Uses a rational economic approach to evaluate all • Extensive collection of best-practice value models; investments on a common monetized scale 70% related to ESG measures • Aligns stakeholders on what delivers value to the • Proven by leading organizations across multiple organization, enabling optimal, data-driven decisions industries Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 9

Future State: Centralized, Intelligent Environment for Decision Making Maximum Time-based Optimized business value decisions plans Transparency Continuous Single source planning of truth Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 10

Solution Delivers High ROI Clients Have Recovered Their Investment within the First Planning Cycle IMPROVED PLANNING HIGHER- IMPROVED PLAN ENHANCED RISK EFFICIENCY VALUE PLANS EXECUTION MANAGEMENT 50% reduced 20% more value 10% improved 200% less risk planning time from portfolios execution accuracy for the same spent CLIENT RETENTION Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 11

Case Studies Organizations managing critical infrastructure trust Copperleaf to help them allocate their financial capital and resources towards the most valuable areas of their businesses: National Grid Duke Energy Anglian Water Gas Transmission UK Integrated Asset Investment Enhanced Risk Portfolio Planning & Management Management Optimization Estimated Value Estimated Value Estimated Value £ % £ 11M 30 10M CAPEX savings per year Reduction in asset risk Productivity benefit per year Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 12

$12+ Billion Market Opportunity in Critical Infrastructure Aviation Communications Electricity Government Manufacturing Metals & Processing & Mining Natural Gas Oil & Gas Ports & Rail & Roads & Water Waterways Transit Highways Manage risk • Improve performance • Drive strategy • Maximize value Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 13

Copperleaf Helps Manage $2.6 Trillion of Assets Worldwide Proven Global Expansion Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 14

Powerful Land & Expand Model Defines the Client Journey Enterprise-wide planning excellence 5 Additional LOB expanded planning excellence UEAL 4 V In-LOB feature expansion LOB centre 3 of planning excellence 2 Discovery Single LOB Multi-LOB Expansion 1 In LOB Expansion Enterprise-wide TIME & INVESTMENT Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 15

Strong Global Tailwinds Supporting Our Market Inflection Point Increased Availability and Accessibility of Data Acceleration of Digital Transformation Increasing Infrastructure Investments Globally Changing Demographics Resulting in “Brain Drain” Growing Importance of ESG in Decision-Making Frameworks Increased Governance Requirements and Shifting Regulatory Environment Continued Global Energy Transition Climate & Cyber Events Increasing Pressure on Critical Businesses Emergence of International Standards Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 16

Multi-Faceted Growth Strategy Expand Beyond Critical Infrastructure Sectors Further Expand Our Alliance Ecosystem Further Develop the Copperleaf Community Extend Our Technology Leadership Expand Within Our Client Base Acquire New Clients Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 17

The Copperleaf Experience & Culture The Copperleaf Experience is culture-led. It's our commitment People set this company apart. And culture is what makes to delivering exceptional value and providing extraordinary people want to be part of what we’re building. Culture is experiences to our clients through teamwork. the way we think, act and interact every day, with everyone. Deliver Exceptional Value Provide Extraordinary Experiences Be Open Be Agile Be Respectful Create Joy Always Improve Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 18

Strong Growth Momentum Total Revenue (CAD $ millions) YoY Growth 10% 21% 74% YoY Growth 55% YoY Growth 69% $64 $45 $47 $34 $37 $28 $17 $11 2018 2019 2020 TTM Q3 2020 Q3 2021 YTD 2020 YTD 2021 TTM (Trailing Twelve Months) and YTD(Year to Date) measured at Sep 30,2021. Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 19

Strong Growth Momentum Annual Recurring Revenue Revenue Backlog (CAD $ millions) (CAD $ millions) YoY Growth 32% 66% 52% YoY Growth 16% 110% 50% $33 $79 $26 $69 $16 $12 $29 $33 2018 2019 2020 Q3-2021 2018 2019 2020 Q3-2021 Q3-2021measuredat Sep 30,2021. Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 20

Investment Highlights Global leader in Decision Analytics for critical infrastructure – Disruptive enterprise AI-powered software focused on large underpenetrated market High ROI driving 100% retention of clients – Mission-critical software embedded in our clients’ decision-making processes and transforming the way they see value Deep, data-driven competitive moat – Highly complex AI-powered optimization based on proprietary value models creating a global community network effect Strong global tailwinds – High value market opportunity accelerated by ESG, the energy transition, and the need for continuous adaptation Attractive financial profile – Strong growth momentum via multiple vectors Passionate leadership team with track record of success – Promoting a high-growth client-focused culture that ‘creates joy’ Copperleaf Technologies Inc. © 2020 Proprietary & Confidential I 21

Transforming how the world sees value Copperleaf Technologies Inc. © 2022 Proprietary & Confidential I 22